The First Home Battery Built to Last 20 Years

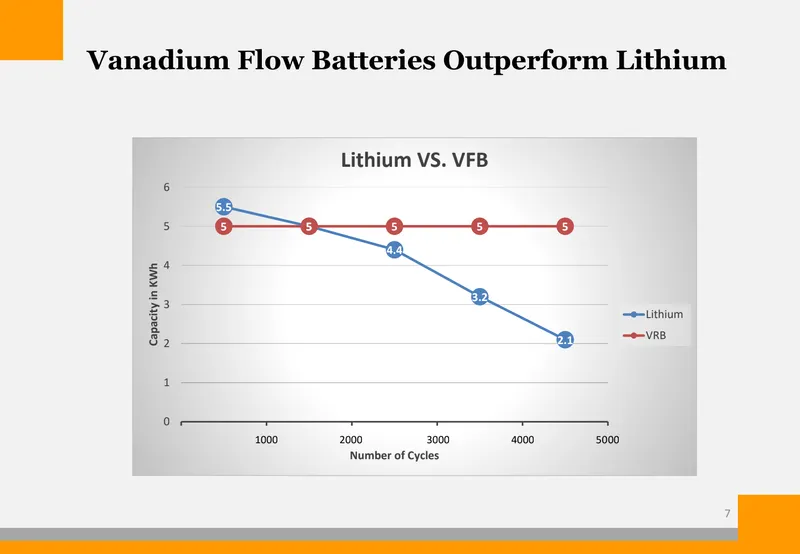

Our vanadium flow battery is the first of its kind built specifically for homes—and it lasts up to 7X longer than lithium-ion. With $11M+ in projected sales and 9,000+ investors already on board, we’re positioned to lead the $20B home energy storage revolution.

Investment Highlights

$11M+

in projected sales from pre-orders

Short Lifespans Are Holding Back Home-Powering Batteries

Many lithium-ion batteries for powering homes last ~5 years. But homeowners expect them to last 20+ years.

~5-year lifespan4

Many people expect key systems like energy storage or cars to function reliably for 20+ years, but this doesn’t reflect reality.

Fire hazards

Overheating is a huge safety concern with batteries that support home energy storage, electric vehicles, and telecom.

Electronic waste

A shorter lifespan on lithium batteries means frequent replacements, which leads to more toxic waste.

Get Your Investor Deck

7x Longer-Lasting Batteries for Home Use

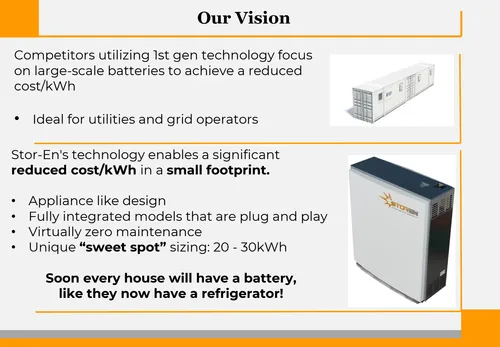

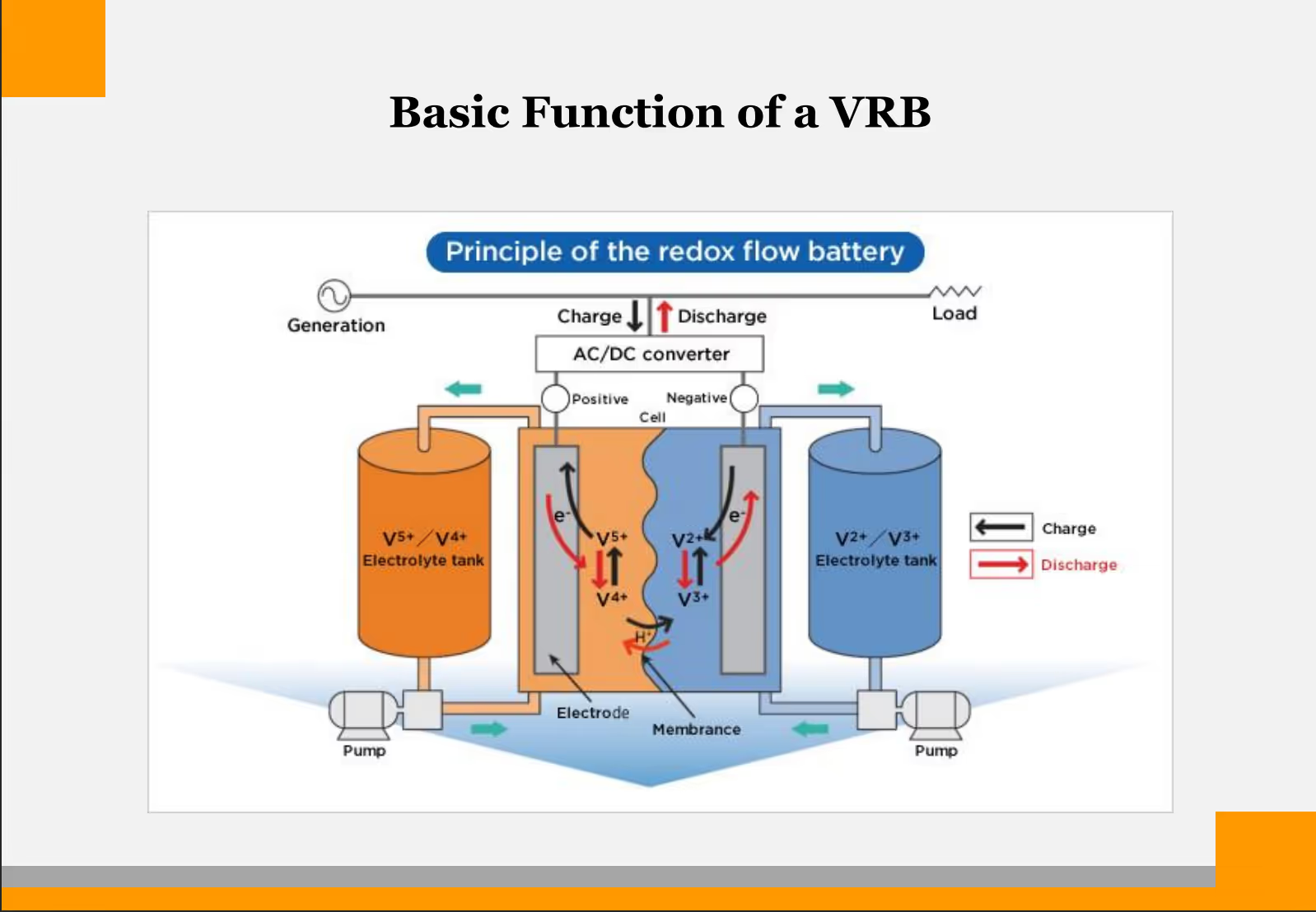

Because they’re so stable and durable, vanadium flow batteries are already used to power major cities and power plants across the world. We are offering that same power in a smaller package designed for longer life and lower costs for consumers to adopt.

Unmatched 20-year lifespan

20,000 cycles for decades of reliable use.

100% recyclable, non-flammable design

Better for the future of our planet.

Small enough to fit inside a garage

Fits seamlessly in residential garages or small commercial spaces.

Get to Know the Science Behind StorEn’s Battery Innovation

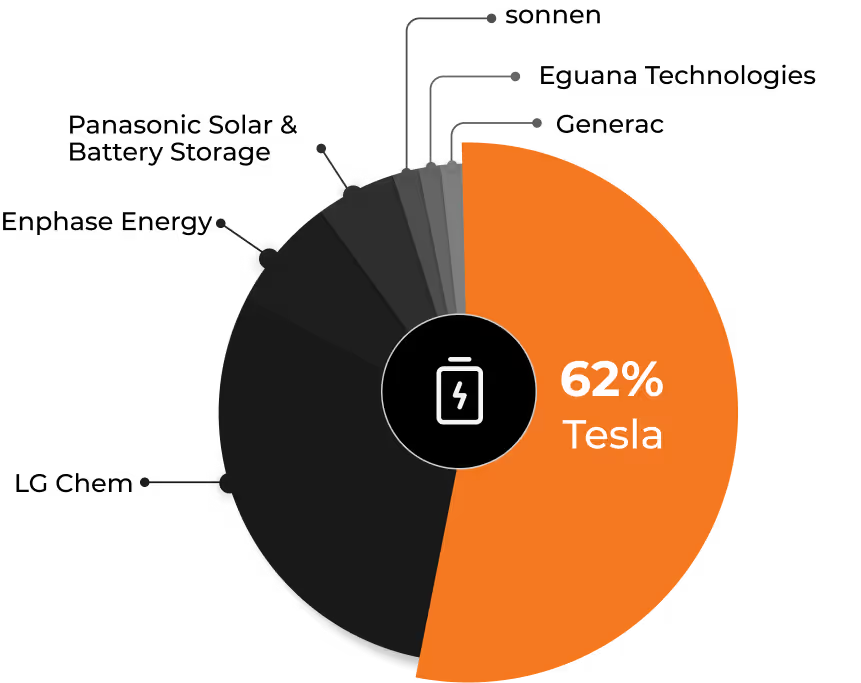

Our Tech Beats Tesla’s Powerwall

Tesla controls 62% of the home-powering battery market. But our vanadium flow batteries last 2x longer.

Overheating is a huge safety concern with batteries that support home energy storage, electric vehicles, and telecom.

A shorter lifespan on lithium batteries means frequent replacements, which leads to more toxic waste.

Tapping Into a $90B Opportunity

The residential energy storage market is projected to surpass $90B by 2033.1

We’re the first vanadium flow battery targeting this market—100% of current solutions rely on lithium batteries.

Expanding into telecom and microgrid, both markets valued at billions annually.

Tesla holds a 62% market share, meaning there’s plenty of room for our disruptive technology to compete.2

Millions in Projected Revenue

With a fast-growing investor community and manufacturing capacity, we’re set to become a leader in the energy storage revolution.

$540,000 in pre-orders

from our V5 Club Investor Purchase Program.

$11M in projected revenue

driven by a backlog extending through 2025.

Get Bonus Shares With Your Investment

Investors who act before October 20th may be eligible to receive up to a 30% bonus in share.

Scaling for Global Impact

As demand for safer and more sustainable energy solutions grows, we’re scaling to meet the challenge:

Scaling Manufacturing:

Expanding production capacity to fulfill increasing orders across residential, telecom, and industrial sectors.

Global Reach:

Plans are in motion to bring our innovative technology to international markets, leveraging partnerships and strategic alliances.

Led by Visionaries in Energy Storage

StorEn’s leadership combines expertise in battery technology and business development.

With more than 23 years experience in the fuel cell and electrolyzer development, Angelo holds 18 WIPO patents in Vanadium Flow Batteries and Fuel Cells. He received the 2003 Sapio Award in the Energy and Transportation category with a paper titled “Technological Transfer between Research Institutions and Companies in the Polymer Electrolyte Fuel Cell Technology".

Angelo is the Founder and Director of StorEn since its inception in January 2017.Angelo has a mechanical engineering background and holds an MBA degree from the LUISS Business School in Rome.

A Swiss/American dual national, graduated from the University of Washington (Seattle - WA - USA) with a BA in International Commerce and Marketing. He completed his academic career with post graduate studies at the SDA Bocconi University (Milan, Italy) in collaboration with New York University.

He has extensive experience in Corporate, Industrial, Event-Project Management & Finance, Mergers & Acquisitions (M & A) including development and awareness activities.

Since 2017 he is living in Rome, Italy with his family residing on several corporate and NGO boards as well as providing active support to a select group of Rome based organizations and initiatives.

John has over 28 years executive level experience in company management, sales and business development.

Over the course of the last 20 years, John has worked with a number of flow battery and fuel cell companies including, RedFlow LTD, Deeya Energy, VRB Power, and ReliON Fuel Cells.

John was also instrumental in the standardization of hydrogen fuel cells used as stationary backup power at many telecom sites in the US and the Caribbean.

John has an engineering background with a B.S. in Electrical and Computer Engineering from Clemson University.

Jessica's journey to tech storytelling in the fast-paced world of national media, producing for NBC and Sirius XM Radio in Washington, DC. It was there she discovered a crucial gap: brilliant technical innovations were getting lost in translation.

Today Jessica partners with technical founders to unlock their full market potential. Her unique methodology combines newsroom experience with strategic vision, helping companies translate complex innovations into compelling market opportunities.

A sought-after voice in the tech community, Jessica has Keynoted at Google’s Headquarters in NYC and at SXSW Interactive. She holds a Master’s Degree in Communications from Johns Hopkins University.

Davide Biggi graduated with honors from the University of Pisa in Corporate Finance and Financial Markets; with 15 years of work experience he has acquired specific skills in financial planning and management starting from the drafting of the annual budget to the reporting period for management. His skills include treasury management, corporate tax planning and management and the auditing of medium-sized companies up to the drawing up of the Annual Report.

Biggi has specialized in the drafting of business plans for the raising of capital (equity and debt) with numerous successful operations - and also in the preparation of financial plans for Facilitated Finance for the collection of European public funds.

He has covered the role of responsible administrative and accounting for a medium-sized multinational group in the naval field located in Europe and USA - and the role of independent financial analyst designated to raising capital of small and medium-sized companies. He has held the role of CFO in two medium-sized companies in the field of shipping and energy.

FAQs

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of StorEn (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities;

• An accredited investor;

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships).

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

What kind of shares are you issuing?

Common Stock.

Where can I find the company’s SEC filings?

All of Issuer’s regulatory filings, including financial reports, can be found here: SEC Filings.

How much are you raising?

$3,602,931.68

How will I get a return on my investment?

A. Investing in startups is risky and there is no guarantee you will get a return on your investment. However, an exit opens up the opportunity where you could convert your shares into cash or a more liquid asset. Exits include going public, getting acquired by a larger company, or our company buying back shares. If the value of our company grows, then you have a higher potential of making a profit on your investment during one of these exits.

B. You are investing in a pre-revenue company. Success will be measured in progress towards revenue. Future liquidation events could include acquisition or an IPO.

When will I receive my shares?

Shares will be rewarded after the investment funds clear. This typically takes around 3 weeks after investment.

Are there higher fees if you invest via credit card vs. ACH?

No, costs are the same, regardless of how you invest.

How will I(investor) make money?

Our investors will realize a positive return after the company is acquired or goes public through and IPO.

How do I know people will buy this solution?

We presently have orders for systems and hope to begin delivery in the next few months.

Are there more opportunities ahead?

Yes, we would like to develop systems specifically to industries needing our technology as an alternative to Lead/Acid and Lithium batteries. These systems do not function properly in long duration energy storage applications.

Why didn't a bigger company do this already?

Our proprietary technology allows us the opportunity to be the first company offering vanadium flow batteries in the size and applications no other company has been able to develop.

How do you plan to use the proceeds from this funding round?

We plan to use the funding for operational expenses, product development expenses, and sales and marketing expenses.

What is the current valuation of the Company?

Our current valuation is $73M.

Why should I invest?

Investing in StorEn Technologies offers a great opportunity to participate and back a company that will change the way energy storage is used in Residential, Industrial and Utility scale applications.

How long are you expecting the company to operate before needing another round?

If we are able to raise the full amount it is anticipated that this will allow us to get our product to market. We would expect to need additional capital at that time to market and sell the product.

What is the exit plan for the company?

The plan is to build a successful, valuable company. Exit opportunities like an acquisition or IPO could follow in due course.

What industries are you currently focused on?

We are focusing on industrial, Utility and Residential applications that utilize our unique technology and give us a competitive edge compared to any other technology presently available.

How many investors do you have already?

Presently, We have over 8,500 investors including early founders and friends, as well as, crowdfunding investors who have participated in one of our earlier crowdfunding rounds.

Will you be paying out dividends to investors?

No.

What’s the Company's core business?

The Company’s core business is the development of energy storage products and solutions utilizing our unique Vanadium Flow Battery technology.

Where are your headquarters located?

Our US headquarters is located in New York City and our technical development team is located in Bologna, Italy.

How many employees does your Company have?

The company has 8 full-time employees and a number of part-time contract employees.

When will the Company expand into additional markets and which ones?

The Company will expand into larger-scale systems used in the Utility and Solar Industries. This will take more investment and any expansion will require additional funding.

Do you plan to expand internationally?

Yes, we have opportunities in North America, Europe, South Africa, other African countries and the Caribbean nations.

Can you share the roadmap for the next 3-4 years and when you expect to become profitable?

We plan to grow through organic direct sales, partnerships with industry leaders, and continued advancements in product development. We also plan on growing through acquisitions and mergers that would lead to new markets and potentially IPO status.

Do you plan on licensing your technology?

Yes, that is one of several potential revenue streams.

How many patents do you have?

We have 4 patents filed internationally.

Who are your competitors? What are your advantages against them?

Presently, our competitors are companies that offer Lithium battery systems. This includes companies like Tesla, Generac, BYD, and others.

Who is the main audience target for your product/service?

Our initial customers are residential and industrial customers who want an alternative to lithium batteries.

Are you looking to partner with other companies?

Yes, we would like to build partnerships with companies in the Utility, Data Center and Telecommunications industries.

What have been the main challenges in developing your service/product and how have they been mitigated?

Our main challenges have been the cost of development of our products. Our only source of investment has been Crowdfunding and we hope to increase the funding needed to complete the development of our initial products.